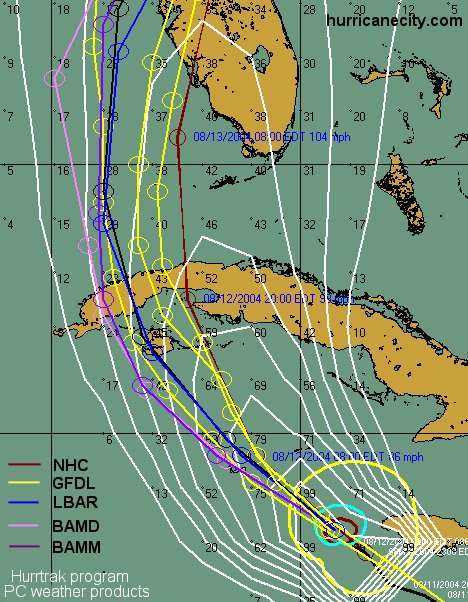

It has become a tradition to try to get a jump on annual predictions that flood industry media by doing mine at the start of the football season. For a number of reasons, 11 weeks into the NFL season and I had not gotten it done yet. Nate Silver’s analysis suggested an 85% likelihood that I would never get a predictions post done this year. But here we are, defying big data. The predictions game isn’t easy (ask Nate). It is a bit like meteorologists who spew out hurricane tracking maps.

They know what they are talking about, they have lots of data, but you can’t always predict Mother Nature. So it is with industry predictions. Regardless, it is valuable to have some transparency on how it went last time out of the gate, if for no other reason than to ensure that your correspondent remains humble. So here is how it went with last year’s seven predictions:

- LEDs emerge and prices start to drop: I predicted that LEDs of many sizes, shapes, use cases and pixel pitches would flood the market, and that prices would continue to drop as a result. We have certainly seen lots of new use cases indoors and out, and just tonnage of new products. A run towards high margin niches is a sure sign of the impact of price pressure from Chinese manufacturers. We will score that one a hit.

- DPAA mission evolves: I looked at the evolution of the DPAA’s membership model and warned of the danger of friction between the old, founders cabal and the new, smaller members. Resolving that, possibly reinventing itself or recasting its mission and how it spends its money would be imperative. The old guard remains firmly in control, and while the Video Everywhere Summit was a success, the announcement of DSF’s Ad Council will raise the stakes in terms of serving ad-supported networks. Maybe a bit early on the call, so we’ll call this one neutral. (Hey, they have ties in the NFL!)

- In proximity, beacons recede while marketing advances: I suggested that the focus of digital signage network operators would turn from a technology (beacons) toward a concept, proximity marketing. Or put a different way, execution as opposed to tools. You don’t hear much about beacons these days, and I maintain they have more value as data collectors than as electronic spambots. And it is data that is driving marketing execution in digital signage and beyond. Beacons have niche uses, but will never be the panacea that some claimed they would be. It was a classic dog whistle. That’s a hit.

- Bigs move their chips: Last year, I suggested that the big companies outside of digital signage would express their interest in the our space via marketing and data-based points of entry, rather than through backend software and devices. I don’t think I got that one right. There has not been discernible interest from the huge multinationals from a marketing and data point of view, and some large companies are still clearly interested in the software and device space. That’s a miss.

- No public pure plays: My thought here was that when I did these 2017 predictions, there would be no public digital signage pure plays. I specifically predicted that RMG would go private and CRI would just go away. Neither of those things has happened… yet. And while I could play a word-parsing game and say that neither is actually pure play, this stretch prognostication was a fail. I own the fail, but not the stocks.

- Trolls back under the bridge: Last year I noted that the troll du jour, Activelight, seemed to be dormant for a number of delightful reasons, but that we should be wary of a sale of their patents. At the same time I noted that the public cry for a legislative solution might tamp down activity. Well, the politicians have waffled under the weight of lobbyists from drug companies and universities, and patent reform is still a dream. Meanwhile, a particularly aggressive new NPE, T-Rex Property AB, is shaking down digital signage networks on a monthly basis. All settlements so far, one countersuit, also likely to be settled. This is what makes them stronger, and me wrong again. A miss.

- Content triggers become more relevant and interesting: I made the case for triggered content to emerge as more relevant, and I believe it has. Tools and applications for collecting data of all kinds have appeared and grown, and among network owners, the need for relevant content seems to hinge on some sort of event- or data-based content capability. We are going well beyond Anonymous Video Analytics, which was early to the trigger game, and we are seeing content triggered by other devices, other applications, and external data. Demands from end users are advancing rapidly, This one was a hit.

2016 Summary: Three hits, three misses and a tie that some might argue was a miss. On that basis I will don my well-worn dunce cap and sit in the corner while I type out this year’s digital signage predictions.

- Solutions Overtake Products

End users of digital signage products have always been cost conscious, often unconcerned with total cost of ownership, effectiveness and future proofing. Markets respond to this in predictable ways. In our case, opportunists on the vendor side have instituted a race to zero in the world of SaaS solutions; poor performing, cheap media players have killed growth plans of some networks; Systen on Chip has been hyped as a cost saver and exposed as a red herring; and buyer’s remorse appears everywhere. That’s not good for anyone.

The truth is, running a digital signage network of any scale is not an afterthought. In addition to robust technology, it requires discipline in procurement, logistics, content and traffic management and the ability to measure results. Smart buyers understand the problems they need to solve, not just the pieces and parts they need to throw in a blender. So I predict that vendors pitching products are going to increasingly lose to vendors selling solutions. Products are sold on features and price. Solutions are sold on value. Low price is a fleeting victory for the buyer. Lasting value is a career enhancer for buyer and seller.

- Consolidation Continues

Last year I passed on making an easy prediction regarding consolidation, so of course that type of activity was high, capped off by STRATACACHE’s summer acquisition of Scala. So after a year off, I am back to say that consolidation will remain a theme. I’ve written often about how the market, despite its growth, will only sustain a small number of Tier 1 software and services companies. This remains true. The Scala deal made many people recognize that effectively, it’s on. It set off a frenzy of rumors, phone calls, lunches and proposals, and some rumors I have heard are fairly humorous. Keep your eyes and ears open at the software, integrator and network levels! As sat down to write this, ContextMedia acquired AccentHealth, so I have already paid the price for procrastination!

- Android is Dead, Long Live Android!

Maybe it’s just me who noticed, but whatever happened to the game changing $99 Android player? The answer is that operating systems are not a silver bullet, and that both players and software need to be commercial grade in order to scale. In the past year or so, the hype and myth around Android have been quietly debunked by reality. The hype artists and their mouthpieces are on to new miracles. Android’s primary value prop was its ability to run on cheap ARM CPUs. Now there are other options, as Intel continues to slowly move Atom CPUs toward ARM-type price points and Linux on ARM becomes doable. Android remains very difficult to justify and manage as a DS platform at scale, as some have learned the hard way. It can be appropriate for certain niche applications and point solutions, and will live on in that world, for now. But the wave of hysteria over Android will continue to recede, even as it marks out its territory.

- Display Manufacturers Can’t Suppress Their Desire to “Go Wide”

I will be happy to stipulate that a great deal of the innovation that occurs in our industry happens in the display space. That said, history tells us that repeated attempts by display companies to provide solutions that include software have failed miserably. Despite the many reasons for a network of any scale to never use a system on chip product or to buy digital signage software from a hardware company, LG, Samsung, Philips and Panasonic, to name a few, will “go wide”, and pitch their own solutions based on some version of SoC and proprietary OS and their own CMS software (to their credit, NEC has thus far resisted the temptation). They will openly compete with their existing software partners without apology and expect those partners to take it and ask for more. You may even see a horrible purchase of a software company once it becomes clear that their own products, well, don’t cut it. Some people never learn.

- Standards Come To Programmatic

The world of ad-supported digital signage has been struggling with programmatic buying for years now. Unfortunately, digital signage does not map well to the web, where programmatic is well ingrained and supports some pretty large companies. There are offerings out there for digital signage, and some will break through. I think the driver of that will be adoption of standards and best practices. For example, one recent entry came to market with big fanfare and a product that exposes the identity of the networks offering unsold inventory at a discount rate. This is a huge no-no, as buyers will soon learn that they can buy cheaply and cancel their full price campaigns, creating even more unsold inventory and killing networks. Standards will solve this and other issues, and digital signage will embrace its own form of programmatic tools. This may become a key agenda item for the Digital Signage Federation’s recently announced Ad Council.

- The Battle Goes Outdoors

Digital out of home (DOOH) is getting ready to challenge traditional out of home (OOH) for eyeballs. There is a huge build-up going on for a war that will be fought outside, as companies line up strategies for entering the largely untapped outdoor signage market, largely in drive-thrus of every stripe. There is a lot at stake, and the battle will be bloody and protracted. There are patents in play, there are competing designs in play, there are global relationships in play, and there are related software deals in play. There are probably a dozen companies going for this brass ring, and the next year may whittle that down some. The prediction is that at least two major users place their outdoor bets in the coming year.

- Mobile Integration Starts to Make More Sense

As an industry, we have struggled a bit figuring out whether mobile is an opportunity or an existential threat. I tend to think it is the former, but there have been lots of false starts in terms of leveraging that opportunity. I was once sure that NFC was the Holy Grail, but Apple crushed that by not opening up its NFC chip inside iPhones beyond ApplePay. Beacons were also not the answer, as described above. Regardless of the technology drivers, the clear opportunity is to make use of the mobile devices that almost every digital signage viewer has. That could be in the form of making interaction with a sign easier and more logical. It could be figuring out a smart way to make select digital signage content available on demand on a mobile device, and thereby persistent, and not location bound. But 2017 should be the year when digital signage finds a way to embrace mobile in a way that works for end users.

So, as a famous porcine celebrity once said, Th-th-th-that’s all, folks! Tune in next year around football kickoff time to see whether I gloat or eat another slice of humble pie. Speaking of pie, Happy Holidays to all!